Most countries in Latin America are unlikely to notably accelerate their deepening economic or security engagement with China over the coming year.

This assessment was issued to clients of Dragonfly’s Security Intelligence & Analysis Service (SIAS) on 16 December 2022.

- While strong, economic engagement between Latin America and China is unlikely to significantly expand over the coming year

- Even newly left-leaning governments, including Colombia and Chile, are unlikely to strengthen their ties with China, although the latter will probably use this prospect to pressure the US to re-negotiate a trade deal

- Latin American countries will probably continue to pursue an approach of pragmatic non-alignment as they seek to leverage US-China rivalries in 2023

The leaders of a wave of new left-wing governments appear reluctant to weaken their ties with the US. Even in Colombia, where President Gustavo Petro has indicated he plans to engage with China, the government does not seem intent on questioning US influence in the region. As such, pragmatic non-alignment will probably remain the predominant policy stance.

Money and more

China is and will almost certainly remain a powerful trade and economic partner for countries across the region. The map below shows that a large number have signed up to the Belt and Road Initiative (BRI). The latest to do so was Argentina, which joined this year. Such ties are not by any means new, but also not necessarily expanding rapidly. The Inter-American Dialogue’s dataset of Chinese bank lending to the region suggests that 2010 marked the year with the most loans issued to Latin America ($34.5bn).

Rather than lending, Chinese investment is much more significant. Energy, metals, and transportation are the top sectors to receive Chinese investment in Latin America, according to data gathered by a US-based think tank. But the nature of those investments continues to shift. In the last few years China seems to have prioritised M&A investments over greenfield projects for which return is less certain, a different US-based policy centre found. Along with electricity, the policy centre found that commodities important for renewable energy development are a key area of expanding trade and investment.

Economic pressure on all countries in Latin America means that they are very unlikely to forgo Chinese investment, loans or the opportunity to access its domestic market trade. But few have publicly indicated that they view China as an exclusive or preferred partner. For example, despite joining the BRI and having a history of mistrust toward the US, Argentina reached a new loan deal with the IMF in March and this month entered a bilateral agreement with the US to improve coordination and information sharing on tax evasion.

Getting leverage, diversifying leverage

Governments are seeking to leverage geopolitical competition between China and the US to their advantage. President Gustavo Petro of Colombia has expressed his willingness to engage China, while still indicating he accepts the US as a significant influence in the region; Petro named his ambassador to the US before that to China. But he wants to renegotiate Colombia’s trade agreement with the US, and in the absence of political will in Washington to do so, we anticipate that he will seek to strengthen ties with China as an attempt to draw attention from US officials.

Meanwhile, the left-wing president of Chile has given little direct indication that he will seek deeper relations with China at the expense of the US. But even in doing so, it is apparent that he is seeking to leverage geopolitical competition. He has criticised other leftists in Latin America, sought to forge strong ties with liberal, foreign leaders and has emphasised climate and environmental standards over rapid exploitation of the country’s mining sector. Still, China is likely to remain a key trade partner for Chile.

Even Venezuela, which is the country most closely tied to China across trade, security and diplomatic relations, appears more open to some re-engagement with the US and other Western countries in the coming year. For example, the government has resumed talks with the opposition, a key demand from the US before considering easing economic sanctions. But Venezuela is highly dependent on China, including for digital surveillance of its citizens, and we doubt that even a broader reopening in ties with the US would alter that.

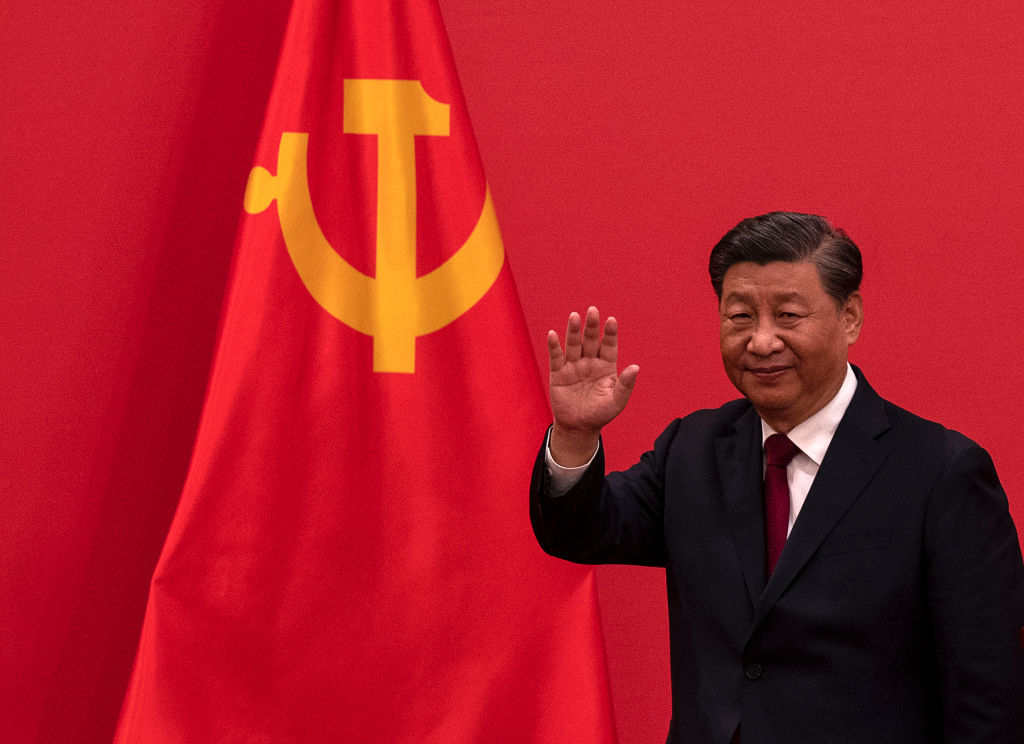

Image: Xi Jinping waves at a press event with Members of the new Standing Committee of the Political Bureau of the Communist Party of China at The Great Hall of People on 23 October 2022 in Beijing, China. Photo by Kevin Frayer via Getty Images.